Depreciation On Furniture Fixtures . Depreciation allows you to expense this gradual loss of value over the. Calculating furniture depreciation is essential for budgeting and financial planning. What is furniture, fixtures, and equipment ff&e? As per section 32 (1), this depreciation rate is estimated on the. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Whereas today, the depreciation rate of furniture and fixtures is 10%. Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. How much value does furniture lose? Furniture and fixtures wear out over time. Furniture depreciation is a significant factor to consider for both individuals and businesses. Follow the steps outlined in this guide to accurately determine.

from present5.com

How much value does furniture lose? Whereas today, the depreciation rate of furniture and fixtures is 10%. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Furniture and fixtures wear out over time. Furniture depreciation is a significant factor to consider for both individuals and businesses. Depreciation allows you to expense this gradual loss of value over the. Follow the steps outlined in this guide to accurately determine. As per section 32 (1), this depreciation rate is estimated on the. What is furniture, fixtures, and equipment ff&e? Calculating furniture depreciation is essential for budgeting and financial planning.

Copyright 2011 by the Mc GrawHill Companies

Depreciation On Furniture Fixtures Whereas today, the depreciation rate of furniture and fixtures is 10%. Furniture and fixtures wear out over time. How much value does furniture lose? When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. What is furniture, fixtures, and equipment ff&e? Calculating furniture depreciation is essential for budgeting and financial planning. Follow the steps outlined in this guide to accurately determine. Depreciation allows you to expense this gradual loss of value over the. Whereas today, the depreciation rate of furniture and fixtures is 10%. Furniture depreciation is a significant factor to consider for both individuals and businesses. As per section 32 (1), this depreciation rate is estimated on the.

From nikkikairon.blogspot.com

Calculate depreciation of furniture NikkiKairon Depreciation On Furniture Fixtures Depreciation allows you to expense this gradual loss of value over the. How much value does furniture lose? What is furniture, fixtures, and equipment ff&e? As per section 32 (1), this depreciation rate is estimated on the. Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. When it comes to. Depreciation On Furniture Fixtures.

From www.double-entry-bookkeeping.com

Fixed Asset Purchase with Cash Double Entry Bookkeeping Depreciation On Furniture Fixtures Calculating furniture depreciation is essential for budgeting and financial planning. How much value does furniture lose? Whereas today, the depreciation rate of furniture and fixtures is 10%. Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. Furniture and fixtures wear out over time. As per section 32 (1), this depreciation. Depreciation On Furniture Fixtures.

From yourgymwiki.blogspot.com

Furniture, fixtures and equipment (accounting) Depreciation On Furniture Fixtures Calculating furniture depreciation is essential for budgeting and financial planning. Depreciation allows you to expense this gradual loss of value over the. Furniture depreciation is a significant factor to consider for both individuals and businesses. As per section 32 (1), this depreciation rate is estimated on the. Furniture and fixtures wear out over time. When it comes to determining depreciation. Depreciation On Furniture Fixtures.

From www.homeworklib.com

Exercise 117 Depreciation methods; partial periods (L0112] On March Depreciation On Furniture Fixtures Depreciation allows you to expense this gradual loss of value over the. Furniture and fixtures wear out over time. Follow the steps outlined in this guide to accurately determine. Furniture depreciation is a significant factor to consider for both individuals and businesses. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Furniture,. Depreciation On Furniture Fixtures.

From www.fastcapital360.com

How to Calculate MACRS Depreciation, When & Why Depreciation On Furniture Fixtures When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Depreciation allows you to expense this gradual loss of value over the. As per section 32 (1), this depreciation rate is estimated on the. Follow the steps outlined in this guide to accurately determine. What is furniture, fixtures, and equipment ff&e? How much. Depreciation On Furniture Fixtures.

From www.bartleby.com

Answered Create Adjusted Trial balance bartleby Depreciation On Furniture Fixtures Follow the steps outlined in this guide to accurately determine. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Furniture and fixtures wear out over time. Furniture depreciation is a significant factor to consider for both individuals and businesses. Depreciation allows you to expense this gradual loss of value over the. Furniture,. Depreciation On Furniture Fixtures.

From www.slideshare.net

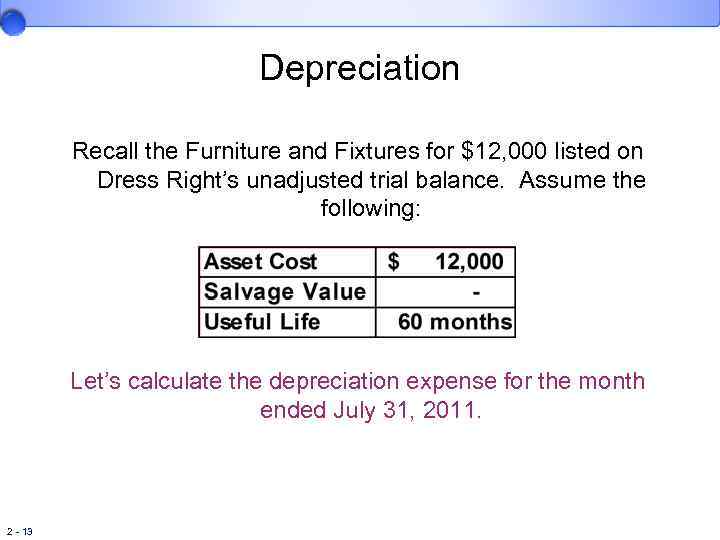

Chapter 2 Lecture Depreciation On Furniture Fixtures When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Follow the steps outlined in this guide to accurately determine. Depreciation allows you to expense this gradual loss of value over the. Furniture and fixtures wear out over time. What is furniture, fixtures, and equipment ff&e? Calculating furniture depreciation is essential for budgeting. Depreciation On Furniture Fixtures.

From www.templateroller.com

DA Form 4079 Fill Out, Sign Online and Download Fillable PDF Depreciation On Furniture Fixtures Follow the steps outlined in this guide to accurately determine. Furniture and fixtures wear out over time. How much value does furniture lose? When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Whereas today, the depreciation rate of furniture and fixtures is 10%. What is furniture, fixtures, and equipment ff&e? Depreciation allows. Depreciation On Furniture Fixtures.

From www.solutionspile.com

[Solved] The following is the balance sheet of Korver Su Depreciation On Furniture Fixtures Furniture depreciation is a significant factor to consider for both individuals and businesses. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. How much value does furniture lose? As per section 32 (1), this depreciation rate is estimated on the. Whereas today, the depreciation rate of furniture and fixtures is 10%. Calculating. Depreciation On Furniture Fixtures.

From charliemontford.blogspot.com

Macrs Depreciation Table Furniture CharlieMontford Depreciation On Furniture Fixtures Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. What is furniture, fixtures, and equipment ff&e? Whereas today, the depreciation rate of furniture and fixtures is 10%. Depreciation allows you to expense this gradual loss of value over the. Follow the steps outlined in this guide to accurately determine. Furniture. Depreciation On Furniture Fixtures.

From westcoastbookie.com

Furniture, Fixtures, and Equipment FF&E Definition Depreciation rates Depreciation On Furniture Fixtures When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. As per section 32 (1), this depreciation rate is estimated on the. What is furniture, fixtures, and equipment ff&e? Depreciation allows you to expense this gradual loss of value over the. Follow the steps outlined in this guide to accurately determine. How much. Depreciation On Furniture Fixtures.

From go-green-racing.com

Furniture And Fixtures Depreciation online information Depreciation On Furniture Fixtures Follow the steps outlined in this guide to accurately determine. Calculating furniture depreciation is essential for budgeting and financial planning. Whereas today, the depreciation rate of furniture and fixtures is 10%. Depreciation allows you to expense this gradual loss of value over the. How much value does furniture lose? What is furniture, fixtures, and equipment ff&e? When it comes to. Depreciation On Furniture Fixtures.

From eireneignacy.blogspot.com

Calculate furniture depreciation EireneIgnacy Depreciation On Furniture Fixtures Follow the steps outlined in this guide to accurately determine. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. Furniture and fixtures wear out over time. What is furniture, fixtures, and equipment ff&e? Furniture depreciation is a significant factor to consider for both individuals and businesses. How much value does furniture lose?. Depreciation On Furniture Fixtures.

From www.chegg.com

Solved a. Sold at a gain of 7,000 furniture and fixtures Depreciation On Furniture Fixtures Depreciation allows you to expense this gradual loss of value over the. As per section 32 (1), this depreciation rate is estimated on the. Follow the steps outlined in this guide to accurately determine. When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. What is furniture, fixtures, and equipment ff&e? Furniture and. Depreciation On Furniture Fixtures.

From kitchenequipmenthankasa.blogspot.com

Kitchen Equipment Kitchen Equipment Depreciation Life Depreciation On Furniture Fixtures Furniture depreciation is a significant factor to consider for both individuals and businesses. Calculating furniture depreciation is essential for budgeting and financial planning. Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. Depreciation allows you to expense this gradual loss of value over the. When it comes to determining depreciation. Depreciation On Furniture Fixtures.

From www.chegg.com

Solved Record the appropriate journal entry to reflect the Depreciation On Furniture Fixtures Calculating furniture depreciation is essential for budgeting and financial planning. Depreciation allows you to expense this gradual loss of value over the. How much value does furniture lose? When it comes to determining depreciation for furniture, fixtures and equipment (ff&e), there are many considerations that. As per section 32 (1), this depreciation rate is estimated on the. Whereas today, the. Depreciation On Furniture Fixtures.

From www.slideshare.net

8013 lecture depreciation Depreciation On Furniture Fixtures Furniture depreciation is a significant factor to consider for both individuals and businesses. Follow the steps outlined in this guide to accurately determine. Whereas today, the depreciation rate of furniture and fixtures is 10%. Furniture and fixtures wear out over time. Depreciation allows you to expense this gradual loss of value over the. When it comes to determining depreciation for. Depreciation On Furniture Fixtures.

From lloydkeelin.blogspot.com

Calculate depreciation of furniture LloydKeelin Depreciation On Furniture Fixtures Depreciation allows you to expense this gradual loss of value over the. Furniture, fixtures, and equipment (ff&e) are items that are not permanently affixed to a building and are consequently easily. How much value does furniture lose? Calculating furniture depreciation is essential for budgeting and financial planning. As per section 32 (1), this depreciation rate is estimated on the. Furniture. Depreciation On Furniture Fixtures.